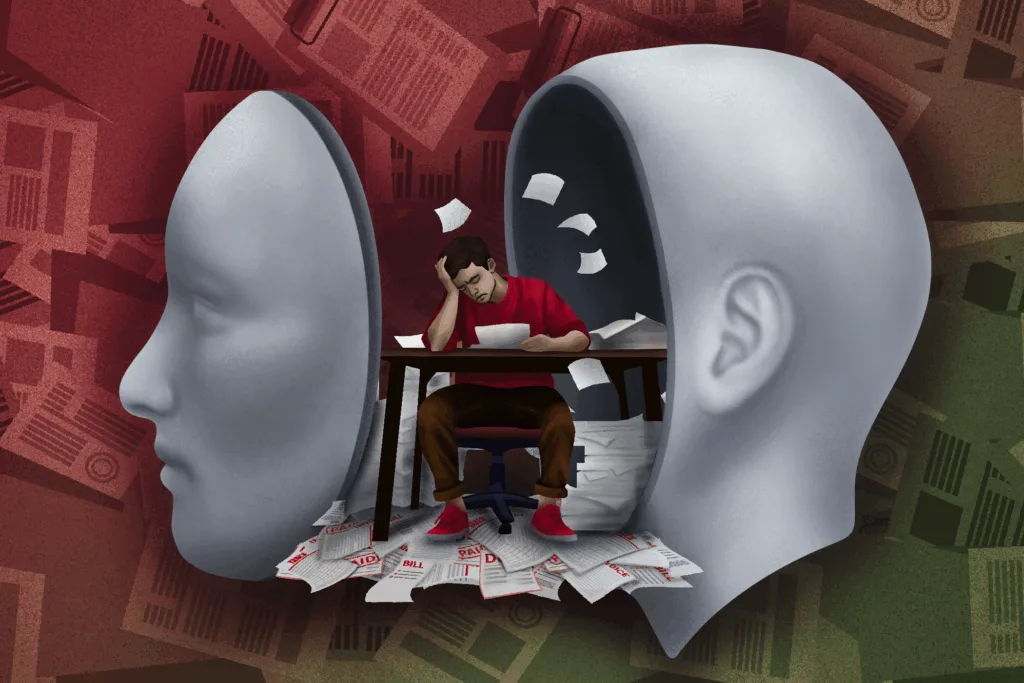

For millions of young adults, financial stress brings more than just repayment plans and interest rates. It can lead to profound mental health challenges.

Gaurav Sinha, an assistant professor at the University of Georgia’s School of Social Work, is examining the intricate connection between mental health and financial well-being, particularly in young adults.

Sinha’s research paints a sobering picture. The burden of debt, especially among 18- to 34-year-olds, can trigger a spectrum of mental health issues, from stress and anxiety to severe depression.

Social Causation vs. Social Drift

At the core of Sinha’s research are two major competing sociological theories. One is called social causation. The other one is social drift.

Social causation argues that being in poverty or low socioeconomic situations directly leads to mental health issues. Social drift theory, also known as social selection, proposes the opposite—that a decline in mental health causes people to drift into poverty. Sinha looks at the interactions of both.

“Debt and mental health inform each other in a circular relationship,” says Sinha. “It’s a feedback loop. People with mental health conditions may find their symptoms worsening because of debt, and the money they have to put into that condition means that the debt increases.”

According to Sinha, both social causation and social drift are playing out simultaneously among today’s youth. A growing number of students are burdened with significant debt before they even graduate. The Education Data Initiative revealed that the outstanding federal student loan balance in the U.S. was $1.693 trillion in 2025, with 42.7 million student borrowers paying back federal loan debt.

“The research shows that among these student debt carriers, you’re seeing more stress, anxiety and low self-esteem with some severe cases of mental health issues like depression,” says Sinha.

Why is Financial Literacy Important?

What’s driving this crisis? One key finding in Sinha’s research is the lack of financial knowledge among young people.

“You turn 18, and suddenly you can sign up for all kinds of debt,” Sinha says. “Credit cards. Car loans. Student loans. Many emerging and young adults don’t even know what questions to ask, let alone what APR to look for or how to manage the loan.”

According to a survey from the TIAA Institute in 2023, many Americans suffer from low financial literacy. On average, adults could only answer 48% of the survey questions. This was a clear sign that many are ill-equipped to make informed financial decisions.

This knowledge gap can make every financial decision feel overwhelming. For those who are already dealing with significant mental health issues, the stress is amplified. Sinha describes it as “cognitive and affective burdens,” the mental bandwidth consumed by constant worry and confusion.

Sinha firmly believes that preventing financial stress begins with education. He advocates for tailored financial literacy programs, especially for young people navigating student loans and who want to know more about their loans.

From car loans with hidden fees to credit card traps, Sinha urges young adults to read the fine print and make decisions grounded in knowledge.

“If someone offers you a new car for $100 a month, it sounds great,” he says. “But look deeper. Is the interest rate higher? Are the terms worse? Understanding these things is crucial.”

When Sinha began this research more than 20 years ago, he worked with low-income families who lived paycheck to paycheck, when most households didn’t even have a bank account.

“Many low-income families were angry, fearful, or sad about their financial well-being. I wanted to know if there was something I could do to help and that’s how this research started. That’s why it’s so important,” says Sinha.

Financial Planning Can Change Your Future

Sinha encourages students and young adults to talk openly—with counselors, friends, family or financial advisors—and to seek help when they need it.

“Young people are driving the world’s economic engine,” says Sinha. “If we provide them with financial knowledge and help for their mental well-being, they can be more productive and they can be better people. Who wouldn’t want that?”

He says that the first step is to acknowledge the debt that you have. The second is to understand that seeking help is not a sign of weakness. It’s a very healthy way to manage your mental health and financial stress.

Talking with someone may reduce your mental load or lead you to resources you didn’t know about. Whether that person is a family member, a therapist or a banker, ask questions before making any major decisions. Once you have a clear understanding of what your goals are and have built a support system, there are many resources for debt management and financial planning:

- The Office of Federal Student Aid’s loan calculator helps estimate monthly payments and predict the impact on your finances.

- UGA Extension’s online resources include articles on debt management and good credit.

- State-Based loan forgiveness programs offer relief for people in certain careers like health care and law.

“Debt does not define you,” says Sinha. “Of course, it’s hard, but it can be managed. And the most important thing that matters is you. You matter. Your mental health matters. Your life matters. Don’t let debt take that away from you.”