The University of Georgia is prepared to help small businesses and nonprofit organizations apply for relief funding now available through the federal Economic Aid Act.

The UGA Small Business Development Center has scheduled three webinars to help explain eligibility for the new funding, which is intended to help Georgia’s small businesses hardest hit by the COVID-19 pandemic.

The UGA Small Business Development Center has scheduled three webinars to help explain eligibility for the new funding, which is intended to help Georgia’s small businesses hardest hit by the COVID-19 pandemic.

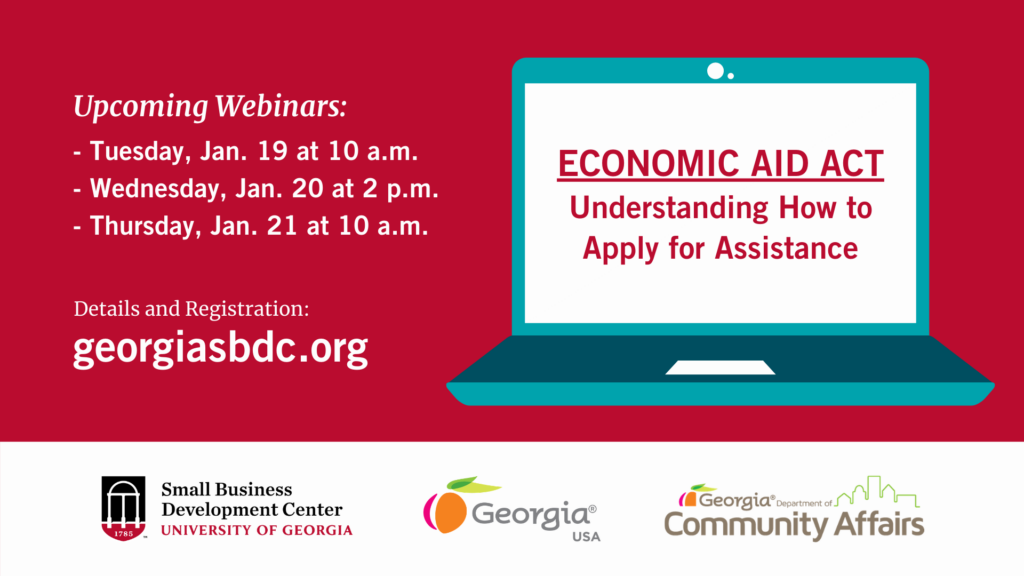

Webinars will be held:

- Tuesday, Jan. 19 at 10 a.m.

- Wednesday, Jan. 20 at 2 p.m.

- Thursday, Jan. 21 at 10 a.m.

The webinars are no-cost to participants but registration is required. Go to https://www.georgiasbdc.org/2nd-round-covid-funding-webinars to register and for more information.

In addition to the webinars, small business owners can seek help with applications by calling consultants in one of the state’s 18-regional SBDC offices.

Most of the funding in the Economic Aid Act, a part of the overall Consolidated Appropriations Act of 2021 signed into law on Dec. 27, 2020, is for programs to support small businesses and individuals, although it does provide for additional programs. This relief package differs from the federal Coronavirus Aid, Relief, and Economic Security (CARES) Act, signed into law on March 27, 2020, in a couple of ways.

“First, and most significantly, the funding for small businesses provides for a more focused support on those businesses hardest hit by the impacts of the pandemic,” said Mark Lupo, a business specialist with the SBDC. “Second, the relief packages include more nonprofit eligibility, even to include public and state-owned organizations.”

“First, and most significantly, the funding for small businesses provides for a more focused support on those businesses hardest hit by the impacts of the pandemic,” said Mark Lupo, a business specialist with the SBDC. “Second, the relief packages include more nonprofit eligibility, even to include public and state-owned organizations.”

Nonprofits interested in more information about available funding and how to apply should contact Sayge Medlin at the UGA J.W. Fanning Institute for Leadership Development, sayge.medlin@fanning.uga.edu, 706-542-4550.

Relief programs include:

- The Paycheck Protection Program (PPP), which is extended in the new legislation, also provides businesses that have been more severely impacted by the pandemic and that meet certain eligibility requirements an opportunity for a second loan.

- The COVID Economic Injury Disaster Loan (EIDL) Program, which is extended for applications through Dec. 31, 2021, offers an EIDL advance for those hardest hit, smaller businesses with fewer than 300 employees that show at least a 30% decline in revenue for a specified period, and are located in low-income communities.

- The Debt Relief Program, which provides for the U.S. Small Business Administration (SBA) to pay the principal and interest from six to 14 months on current and future SBA loans approved up until Sep. 30, 2021. This program is for businesses in the hardest hit business sectors, including restaurants, hotels and some hospitality organizations.

- Additional programs include the Shuttered Venue Operator Grant for smaller organizations, such as live venues, live performing arts organizations, museums, and independent motion picture theatres; rental assistance programs; child care providers; transportation providers; and farmers and ranchers.

During the spring, after the first round of relief funding was released, the UGA SBDC was able to help 3,300 Georgia small businesses secure $88 million in grants and loans.

For more information, go to the SBDC web site at www.georgiasbdc.org