With the Supreme Court’s rejection of student loan relief in June, millions of borrowers are dealing with intense emotions of disappointment and resignation.

According to new research from the University of Georgia, that loan debt could be making America’s mental health problem worse.

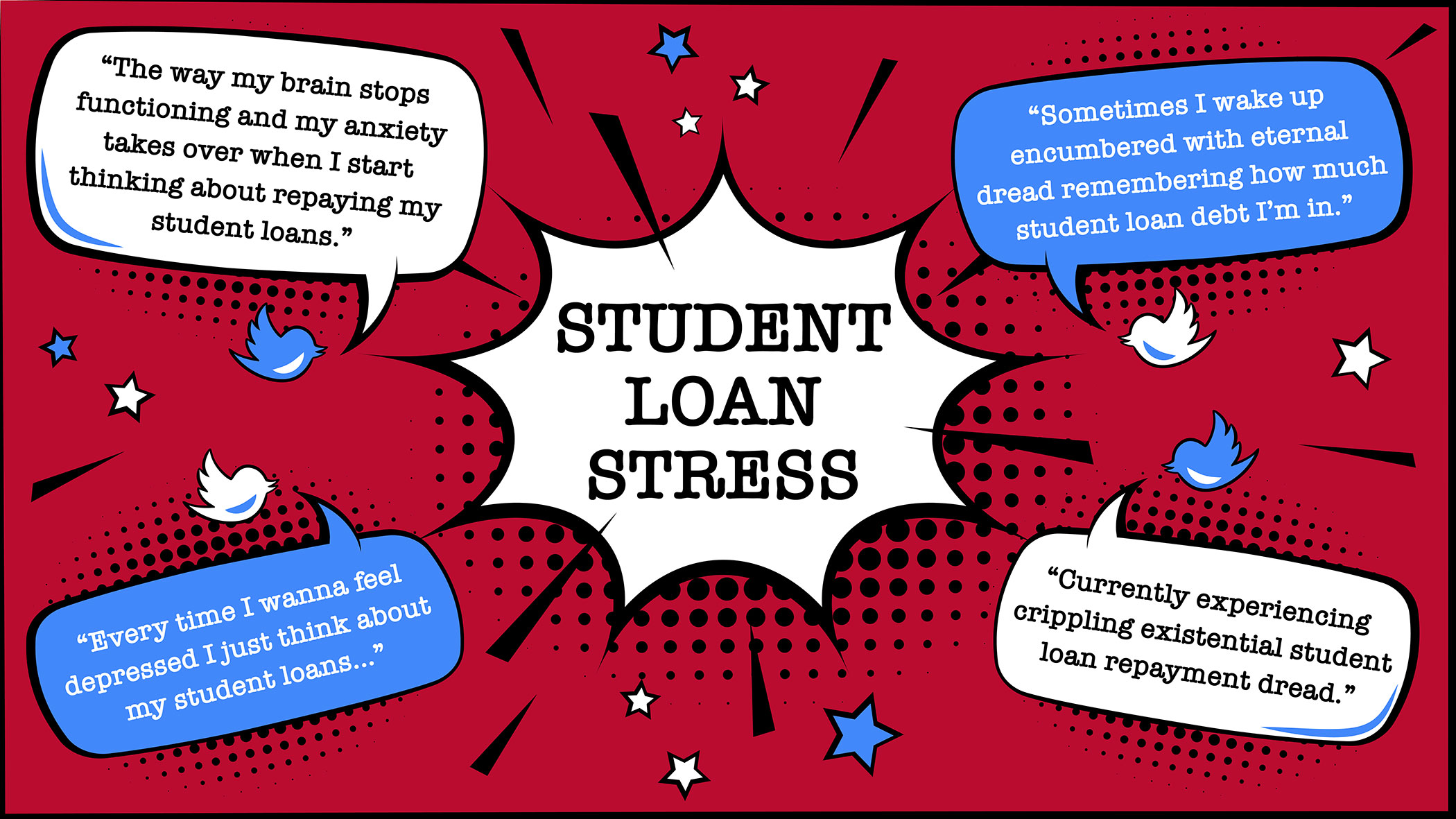

The study analyzed more than 85,000 student loan-related posts on popular social media sites Reddit and Twitter from 2009 through 2020, excluding those from policymakers and political figures. The researchers chose these forums because people proactively go online to share their opinions and feelings on the sites without prompting.

The study found high levels of mental health issues, including feeling depressed, stressful feelings and worrying thoughts, were associated with student loan debt, performance pressure and negative academic and personal outcomes.

“Student loan debt per se is not a bad thing, but people need to know what they’re getting into,” said Gaurav Sinha, lead author of the study and an assistant professor in UGA’s School of Social Work. “People have a limited cognitive bandwidth. We spend a lot of time thinking about money and our debts. That not only affects your financial health but also your mental health.”

That distraction can make it difficult for current students to concentrate on their studies. And for graduates in debt, the mental energy used on loan repayment plans and budgeting can negatively impact relationships.

Mental burden created by debt may exacerbate, lead to mental health problems

The study focused on discussions in finance and mental health subreddits, online communities dedicated to specific topics on Reddit.

For the Twitter posts, the researchers trained a machine learning model to flag tweets expressing patterns of speech and word choice that exhibited common mental illness symptoms.

The researchers found that the majority of user posts were negative, with users expressing symptoms of mental illness sharing higher levels of negativity than those in both the finance subreddits and on Twitter.

Many users had too much money to pay back … They feel trapped.” —Gaurav Sinha, School of Social Work

For the users with mental illness symptoms, the stress of paying back their student loans appeared to exacerbate their condition.

“People shared their doubts over whether they can pay back their loans, and others mentioned worrying thoughts including self-harm,” Sinha said. “Many users had too much money to pay back, they didn’t get those dream jobs they thought they would with their degree and now they don’t know what to do. They feel trapped.”

Users expressing mental illness symptoms stated high levels of sadness and fear about their loans.

Even the users who did not express symptoms or self-identify as living with mental illness were angry and sad about their debt. Almost one out of three of these social media users vented about their anger online. The researchers noted that if those individuals continue to experience prolonged bouts of anger over time, it could lead them to mental health issues down the road.

Most social media users wish they had financial education

One common thread among the posts was the desire to know more about student loans and managing repayment schedules. Many of the social media users said they wished they had more education on the amount of debt they were taking on and what that could mean for their future earnings and savings.

“We need to provide information in a way that people actually understand how student loans work,” Sinha said. “Users said they should’ve learned about budgeting or basic financial management early in their lives or that they shouldn’t have taken on the level of debt they had. These are important considerations many users felt that they should have known.

“We also need to focus on making higher education accessible and affordable to address this problem holistically.”

To counter this lack of financial knowledge, education is crucial, the researchers said. Currently, only few countries have introduced financial education courses into their public school systems. But doing so could help future students understand the potential ramifications of their education loans and promote responsible credit use.

Published in the Journal of Evidence-Based Social Work, the study was co-authored by Christopher Larrison and Ian Brooks, of the University of Illinois at Urbana-Champaign, and Ugur Kursuncu, of Georgia State University.